Fintech (Financial Technologies)

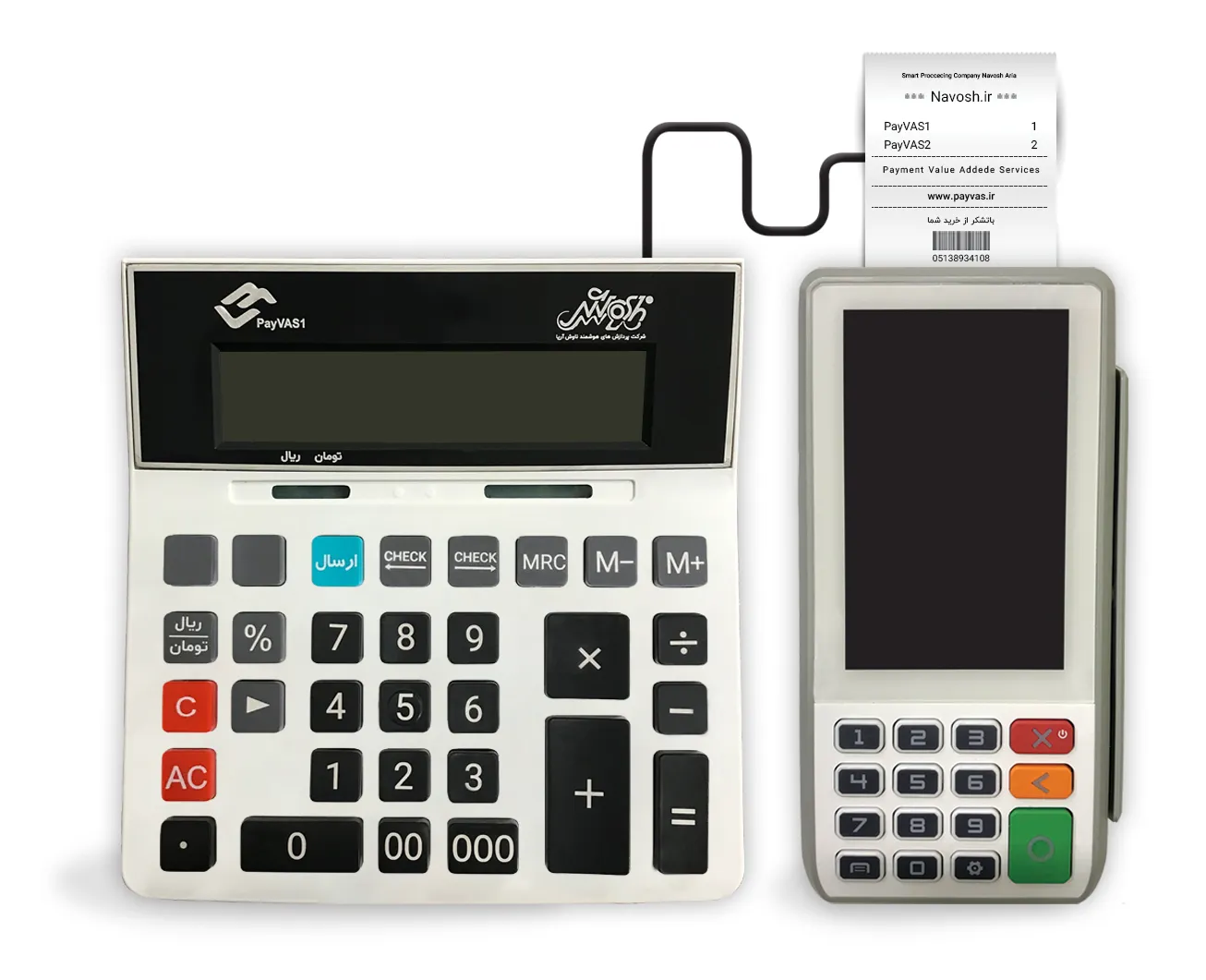

PayVAS1 calculator connected to bank POS

Since calculators are a computing tool and are present in all industries, Navesh Aria Intelligent Processing Company has invented a calculator that can be connected to POS. The very reasonable price and the added value that the calculator creates for the shopkeeper make it a suitable alternative to a PIN pad and cash register. Using FinTech, after performing calculations on the calculator, the acceptor sends the calculation results to the POS by pressing the send button. (In this method, the POS device is at the customer’s disposal.) Upon seeing the number on the POS display, the customer swipes their bank card and enters the password. A beep on the calculator indicates whether the transaction was successful or unsuccessful.

Fintech - PayVAS2 Limited Menu Payment Kiosk

The buyer selects the product they want on the kiosk and upon payment, a receipt is printed by the device to be presented to the seller. Sales reports and work shift scheduling are among the features available on the kiosk.

PayVAS3 NFC base payment kiosk

In some entertainment centers, amusement parks, water parks, etc., NFC cards have been provided, and anyone can use the services of the complex by receiving a deposit and charging that card. To do this, kiosks called charging and settlement have been built and the required number of human resources have been hired. The main problems of this system are the lack of cash to return the remaining charge of the cards and the incompatibility of the charge amount with the services used, which results in additional travel by the visitors. By using this kiosk and using technology to provide financial services (FinTech), in addition to solving all the above problems, significant savings are made in the costs of that complex. The use of this device is to charge NFC cards without the need for human resources.

Fintech - PayVAS4 Cashier Payment Kiosk

This device meets the need of the trades, where the customer must first receive an invoice containing a payment barcode from the seller to make a purchase and then, after the payment process, receive the purchased items by presenting his receipt. The above invoice is generated by scales, accounting software, etc., depending on the type of trade. In this payment system, there is no need to go to the cash register anymore, because the Cashier’s Payment Kiosk is equipped with a barcode recognition scanner and receives the invoice information from the store’s accounting system in a fraction of a second and, after payment, records the operation confirmation in the store’s cash register system.

QR display PayVAS5

QR display for mobile wallet payments

Payment via mobile wallet is one of the fastest and fastest growing payment methods in the financial sector. Navesh Company has developed its new product called “QR Display” based on secure and modern payment infrastructure.

Product Features and Benefits:

Increases payment accuracy and speed:

Unlike traditional paper-based methods, QR displays enable fast, error-free, and resource-efficient payments.

Connectivity to other systems: This display easily integrates with other payment equipment such as bank POS and Navosh smart calculators.

Providing added value to the acceptor and buyer: Ease of use, secure payment, and support for diverse services create a complete experience for users.

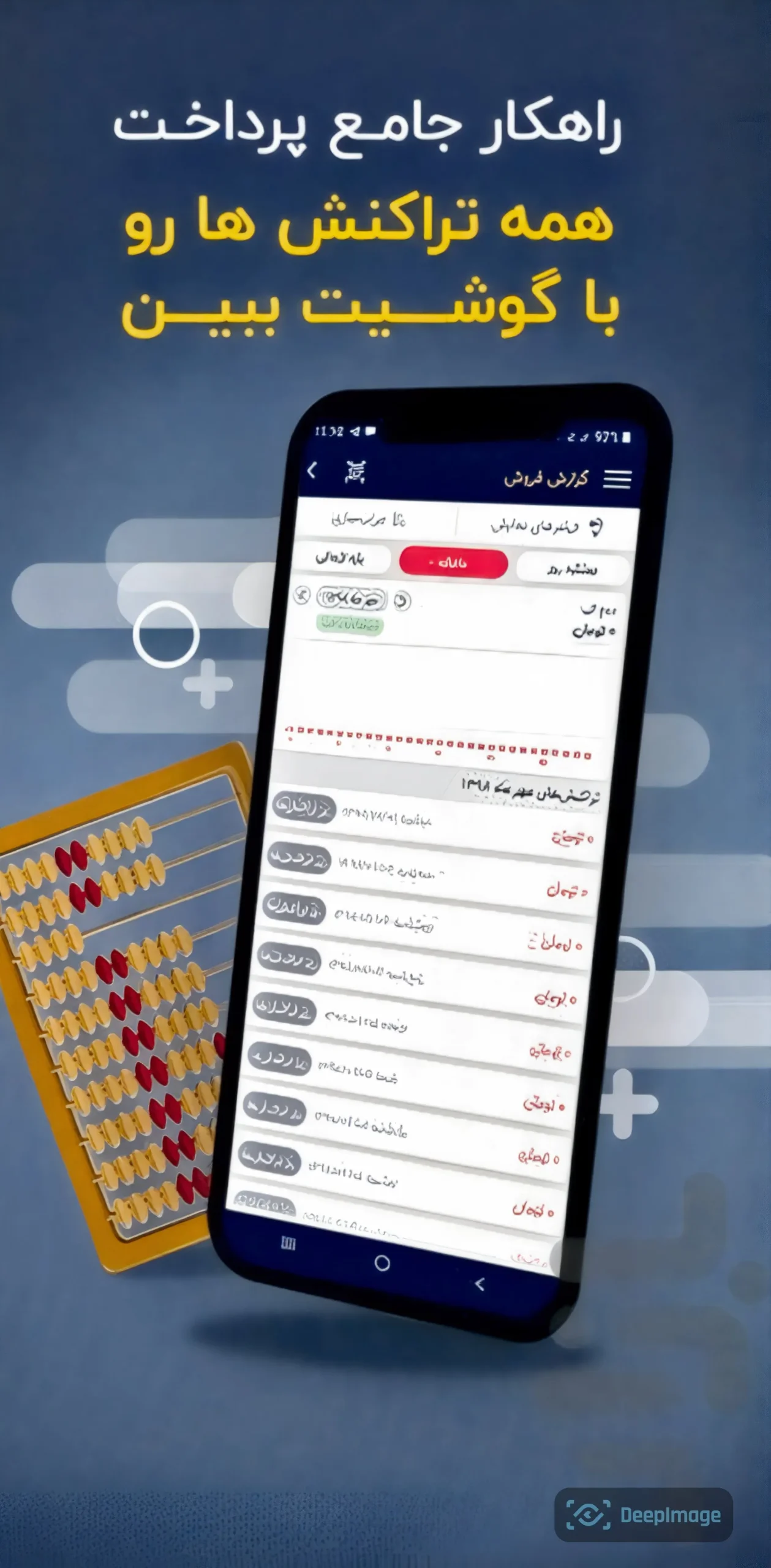

Comprehensive mobile payment platform

A comprehensive mobile payment platform based on two-dimensional barcodes (QR-CODE) creates a framework in a smart city through which citizens can pay on buses, taxis, and in stores using any of their electronic wallets.

To be included in this platform, electronic wallets must connect to the API provided to them.

The holders are the same wallet users who, after connecting the wallet, can easily use the services created based on the QR-CODE with their wallet and do not need to install any special software on their phone.

The recipient is a legal or natural person who, by providing a service or product, has registered a QR code in his name in the comprehensive system.

To use this platform, acceptors must first install the comprehensive acceptor software on their mobile phones and use it after initial registration and completing the acceptor’s financial and legal information.

After the recipient registers, QR-CODE stands are installed at the recipient’s location. After visiting, the recipient scans the recipient’s QR-CODE through his wallet and pays for the services with his wallet or using the Shaparak payment gateway.

The acceptor can view the purchase transactions made by the holder through its own software.

The amount deducted from the holder’s wallet, if the acceptor wishes, after his/her confirmation, or otherwise, the next morning, will be deposited into the account introduced by the acceptor in the contract using the Paya system and the Sheba number.